In a June 4, 2018, Wall Street Journal article by Michael Wursthorn “Value Investors Face Existential Crisis After Long Market Rally”, the author recognizes the disparity between value and growth over the nine year bull market. To summarize, the growth investment style has outperformed value every year except one. Year-to-date, the distinction is even more pronounced, with the Russell 1000 Value return at -2.1% versus the Russell 1000 Growth Index returning +6.9%. Inexpensive sectors such as consumer staples and utilities are down by -13% and -5.5% year-to-date, respectively. These two sectors grow cheaper while expensive sectors such as technology, up +12% year-to-date, continue to appreciate as “accommodative monetary policies broadly lifted asset prices – to the detriment of value investors.” The article cites a few value managers who have “evolved” in their approach to keep pace with what’s popular, with one manager stating it’s difficult “to articulate what value investing is anymore.” In other words, these managers have capitulated and now are chasing returns by reinventing the definition of value.

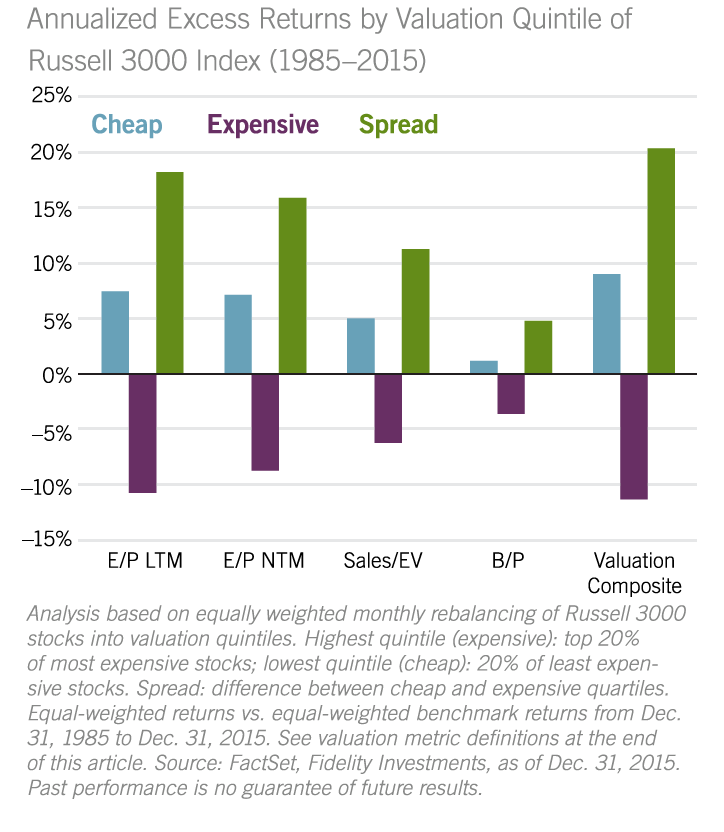

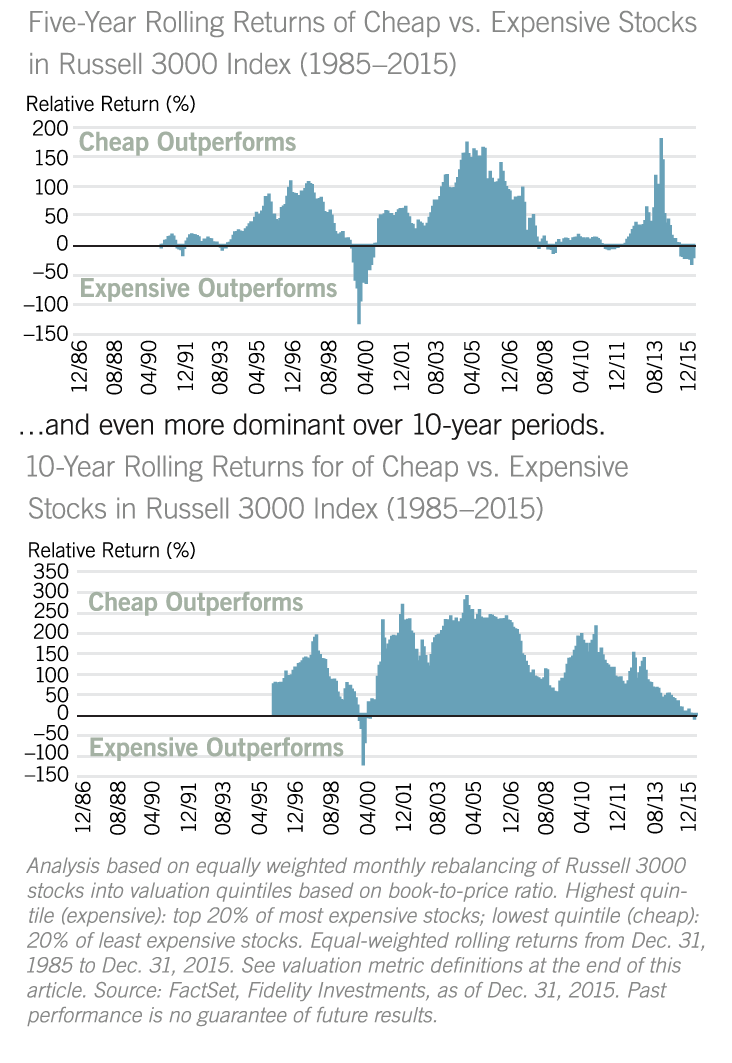

Financial history is littered with articles arguing that this time is different. However, owning quality stocks trading below a conservative estimate of fair value has always outperformed over extended market horizons.

Of course, being a thoughtful value investor demands thorough company analysis, patience and a willingness to invest in a portfolio that runs counter to popular opinion. The best opportunities with the least amount of risk remain out-of-favor companies with strong earnings that are likely dealing with temporary headwinds. These conditions offer the value investor the opportunity to make a sound investment at a compelling entry price.

By contrast, paying up for an expensive stock rarely ends well:

Given the lopsided enthusiasm for the growth investment style, it does not surprise us that our strategy is underperforming the general market. However, this very indifference to value itself is in turn creating an environment where interesting opportunities will exist — our shopping list of potential, high-quality investments continues to expand while the current portfolio’s margin of safety now sits at its largest discount to fair value in last five years; currently trading at 22% below our collective estimates of fair value. We take comfort in the belief that this time is never different. A value investment philosophy by its very nature mitigates risk, with investment entry price serving as the ultimate determinant of future returns for the patient investor.